Import Duty for Cars in Malaysia

Goods imported into Malaysia are subjected to Sales Service Tax SST of 10 and these goods can be anything from food items to electronics. Storage of your car in our safe compound.

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

The import duty on passenger cars with petrol engines range between 140 and.

. Some food items might be subjected to an extra Malaysian Custom Excise import duty such as a. Bespoke sourcing of your vehicle purchase inspection and collection. The country youre importing from has a trade agreement with the UK.

The Tax Free Threshold Is 500 MYR. Cost of maintenance and parts for foreign cars are also factors to be considered. The Customs department of Malaysia has their own method of calculating the open market value of certain vehicle models.

The UK Global Tariff UKGT applies to all goods imported into the UK unless. To calculate the import or export tariff all we need is. An exception applies such as a.

Needless to say if your car is rare or indeed not available in. If required Mileage checks reports. The custom duty will basically depend upon the declared value of the car that is being brought into the country.

Have a valid work permit for the country. Our cars are shipped and insured service to Port Klang or Kuching. Import duties run to as high as 300.

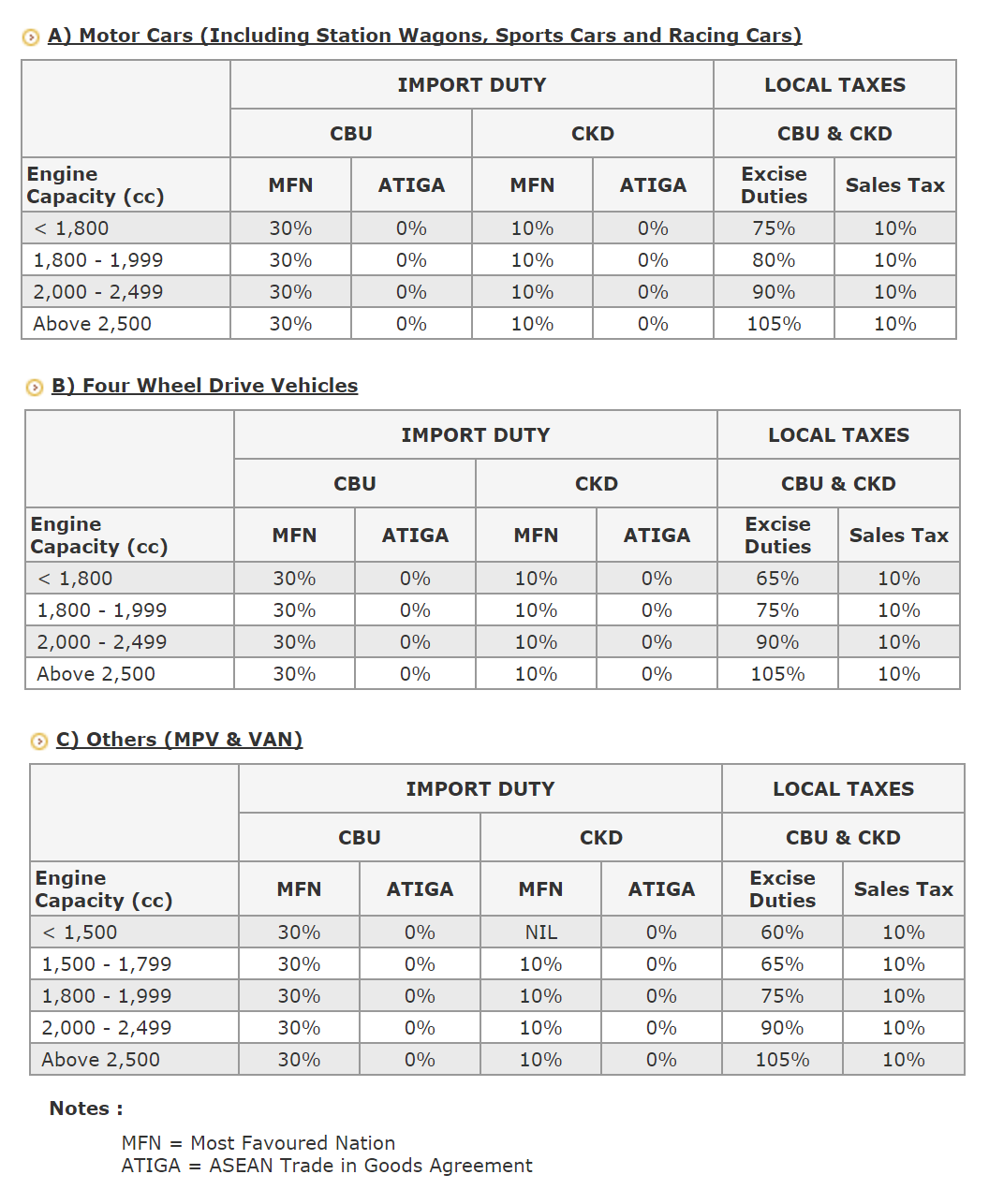

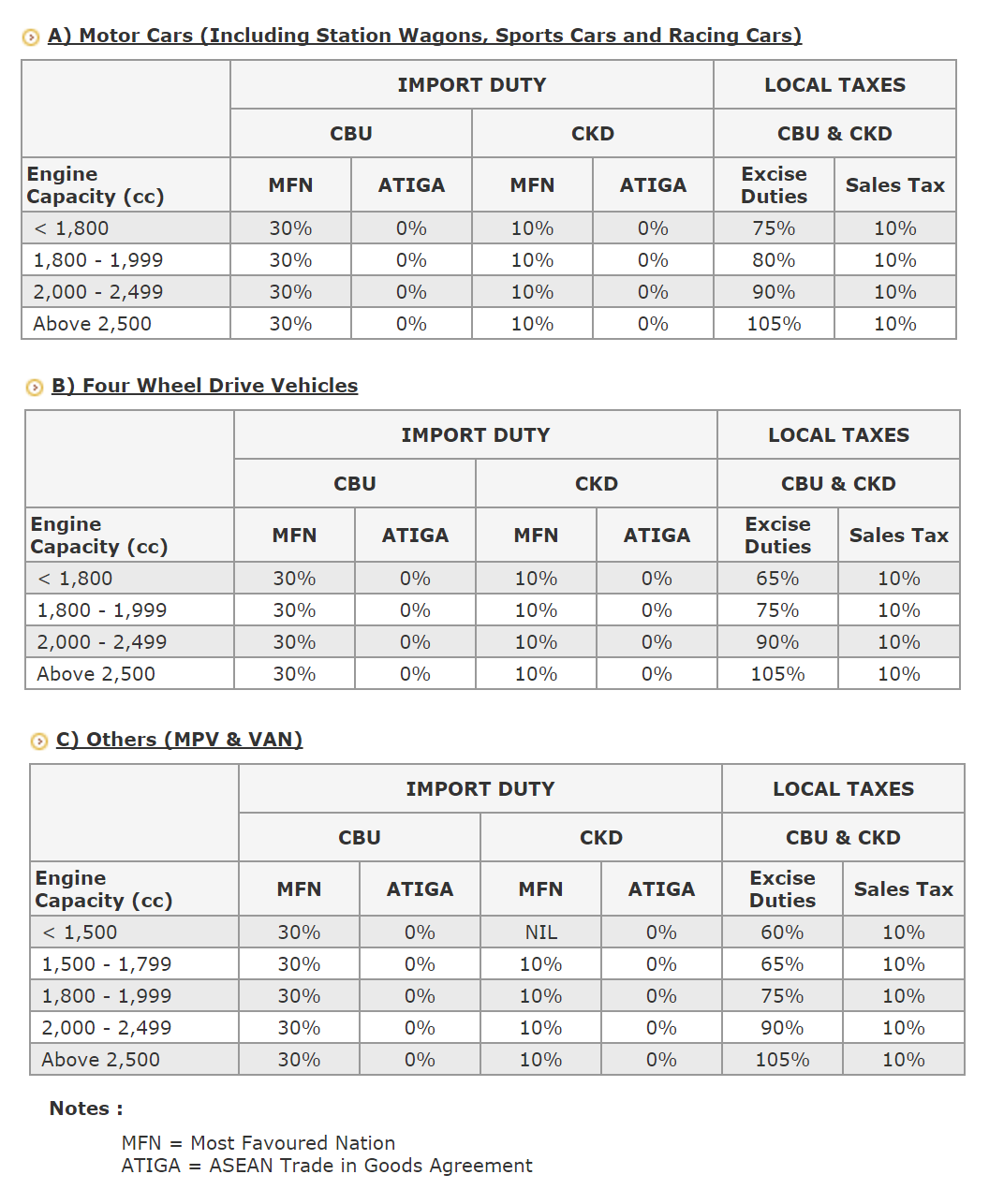

The imposition of very high import duties make owning a non Malaysian made car somewhat expensive. Cars imported from countries or are subjected to 30 percent import duty. Excise duties ranged between 75 percent to 105 percent and are calculated depending on engine capacity.

Please refer to Royal Malaysian Customs Department for official confirmation. It is also expensive to buy parts for foreign cars making them difficult to maintain. Goodada can help you with your Malaysia Import and Export Duty Clearance.

A person who chooses to import a car to the country needs to meet the following conditions. Import duty on various car segments according to their CIF values. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the.

1 January 2019 C COMMERCIAL VEHICLES IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD IMPORT DUTY LOCAL TAXES CBU CKD CBU CKD LOCAL TAXES B OTHER. Our Outstanding Import Service provides you with everything you need to import your car to Malaysia. MAA shall not be liable for any loss caused by the usage of any information obtained from this web site Updated.

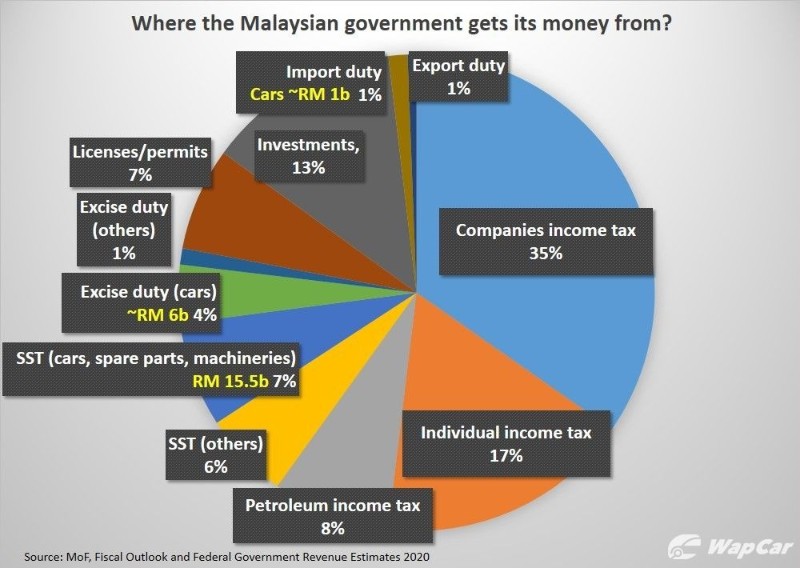

If the full value of your items is over 500 MYR the import tax on a shipment will be 10. In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. Import duties can be much more than a cars value.

Our Malaysia Customs Broker can assist you to calculate import and export Duty charges. Consequently the vast majority of cars in Malaysia are locally produced ones. Its fast and free to try and covers over 100 destinations worldwide.

Calculate import duty and taxes in the web-based calculator. For example if the declared value of your items is 500 MYR in order for the recipient to receive a package an additional amount of 5000 MYR in taxes will be required to be paid to the destination countries government. SALES TAX10 of the sum of CIF value of the car and the import duty will be charged as sales tax.

IMPORT DUTY ON 4X4 VEHICLES AND OTHERS 60 of the CIF value will be charged for vehicles having up to 1799cc engine. Importing a car into Malaysia is very expensive. However some goods are taxed at the reduced rate of 5 while others are completely exempt from sales tax.

Now that Malaysia is in a recovery period from the 3-month standstill during the Movement Control Order MCO Barjoyai said that it would be a good chance for the. The value of your order.

![]()

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

Malaysia Import Regulation Taxes For Japan Used Cars

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Importing Cars In Malaysia Expatgo

Do You Know That Malaysia Is Known For Having One Of The World S Highest Taxes On Cars Ezauto My

Comments

Post a Comment