Explain Different Costing and Pricing Methods to Make Business Decisions

So let us look at some of the most common and popular methods of costing. Methods of Costing Job Costing Contract Costing Batch Costing Process Costing Unit Costing Operating Costing Operation Costing and Multiple Costing.

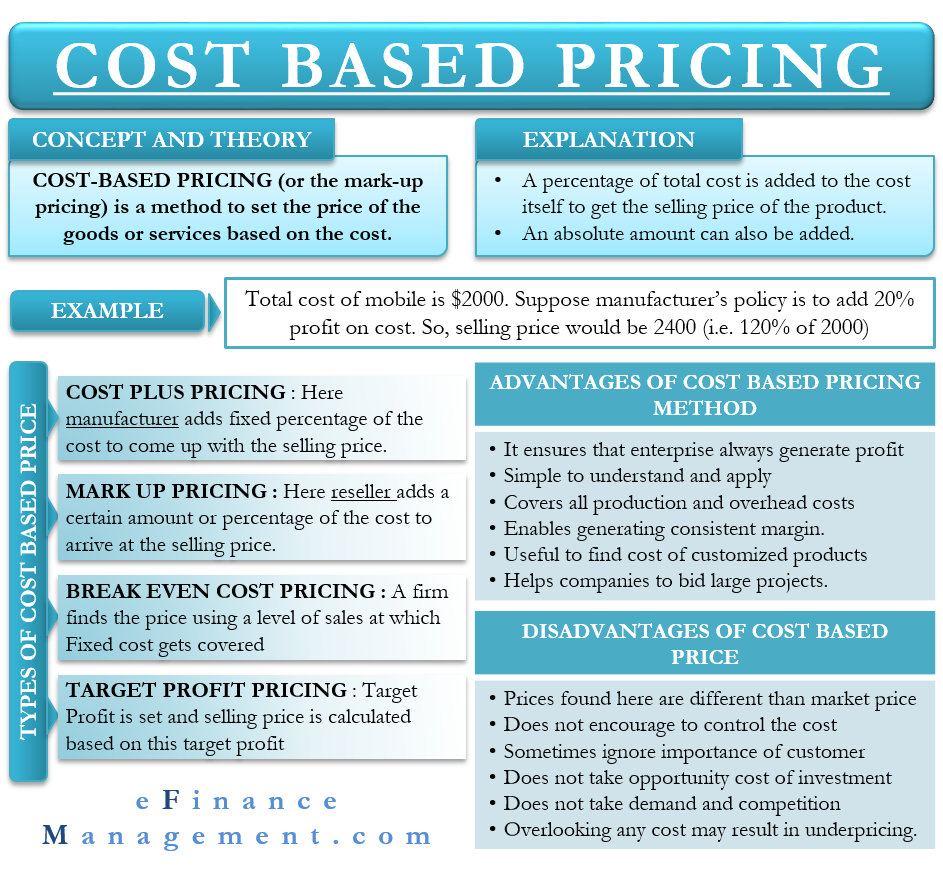

Cost Based Pricing Meaning Types Advantages And More

A fixed cost such as rent does not change in lock step with the.

. Such a method may result in price to be different from the market rate. Download the full version above. The method of costing refers to a system of cost ascertainment and cost accounting.

It has been View the full answer. The method is also known as cost-plus pricing. The type of costing method used can result in substantial differences in costs.

A pool of activity costs associated with particular processes and used in activity-based costing ABC systems. There is no pre-production here each order is made to the specifications needed. Each of these methods applies to different production and decision environments.

This is the most commonly used method. First week only 499. Activity-based costing is a costing methodology that aligns a manufacturers resources and their activity to the companys products andor services as it relates to their cost consumption.

This page of the essay has 88189 words. This method is used in construction business professions and even for consumer goods. In view of the complexity of businesses and increasing changes in industry trade.

Start your trial now. Short-run decisions include pricing for a one-time-only special order with no long term implications. Many firms consider the Cost of Production as a base for calculating the price of the finished goods.

If you plan on competing on price you will want to ensure that your product is priced lower than that of your competitors but if you sell your product for less than its cost you wont be in business for very long. The cost concepts are. This method does not encourage business to make efforts to control the cost.

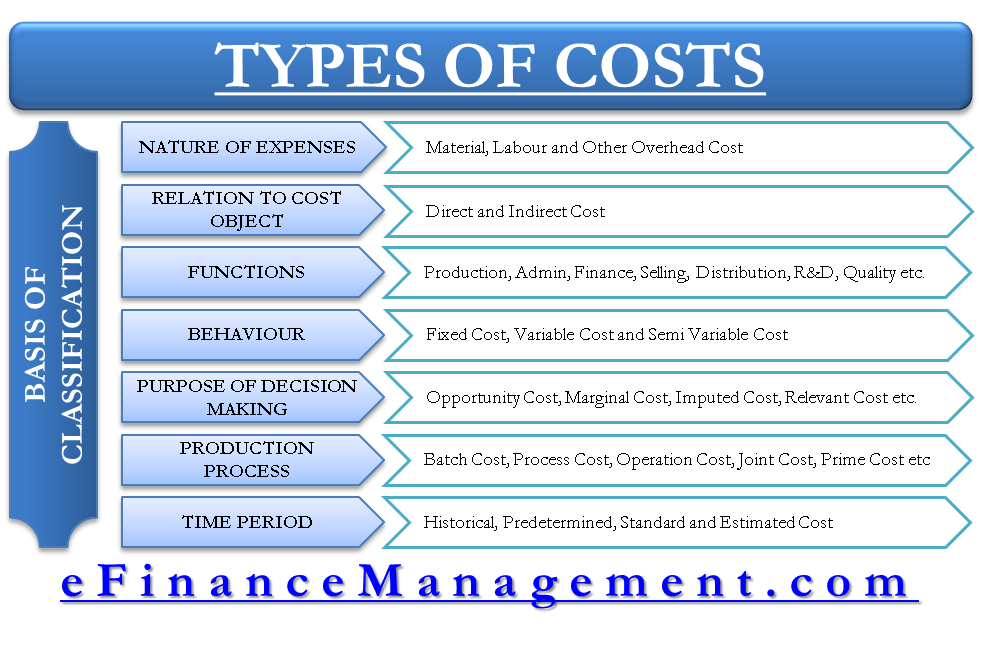

Fixed Variable and Mixed Costs. The expenses are recorded in stage wise production of units or products. The number of units produced to get unit or single output cost divides the total production cost.

Different costing methods to make business decisions in Insurance Company Complexity- Every Insurance company has a large variety of products insurance companies use different brands to sell life insurance and general insurance products. Cost-oriented pricing method covers the following ways of pricing. Explain different costing and pricing methods to make business decisions.

Avoidable Cost and Unavoidable Cost 9. The two ends of the time horizon are. The different pricing methods Figure-4 are discussed below.

It is one of the simplest pricing method wherein the manufacturer calculates the cost of production incurred and add a certain percentage of. Explain different costing and pricing methods to make business decisions. It is because the company simply passes the cost to the buyers under this method.

While costing is useful for setting a normal sales price it is also useful for determining whether or not to take special orders at lower prices. Solution for Explain different costing and pricing methods to make business decisions. The different methods of pricing can be grouped under the following broad categories.

In the case of the Ultimate Planner that we have been discussing during this module getting all of the costs from direct materials direct labor and overhead into the cost of the product will allow managers to appropriately price the product so the company. In this method a standard mark-up or profit margin is added to the product costs. The following points highlight the top nine cost concepts used in decision making.

Cost-based pricing refers to a pricing method in which some percentage of desired profit margins is added to the cost of the product to obtain the final price. The main costing methods available are process costing job costing direct costing and throughput costing. This method is used where uniform products or units are produced in large number and able to find out cost per unit or product.

Relevant Cost and Irrelevant Cost. In such cases we use the job costing method. Unlike job costing methods activity-based costing incorporates more indirect costs into direct production activities to help drive pricing decisions.

Either the price could be much high to discourage buyers or too low to result in a loss. Cost Concept 1. Product Line-Oriented Pricing.

Consequently when reviewing a business case to determine which path to take it is useful to understand the following cost concepts. Many firms and businesses work on a job work basis. The time horizon of the decision is critical in computing the relevant costs in a pricing decision.

Single Output or Unit Costing. Industries differ in their nature in the products they produce and the services they offer. Here the cost is assigned to a specific job assignment etc.

Product costing methods are used to assign a cost to a manufactured product. In other words cost-based pricing can be defined as a pricing method in which a certain percentage of the total cost of production is added to. Costing is basically the ascertainment of cost whether for a specified thing or activity.

Different types of costs have differing characteristics. To ascertain cost we need to apply accounting and costing principles methods and techniques Costs may be historicalbeing incurred or estimates. Text preview of this essay.

Out of Pocket Costs 3. Managers are always looking for more effective ways to figure out the cost of their products. Many business decisions require a firm knowledge of several cost concepts.

Types And Basis Of Cost Classification Nature Functions Behavior Efm

Introduction To Cost Management And Decision Making

Activity Based Costing Time Based Or Driver Based Abc System Cost Accounting Abc Activities Marketing Budget

Introduction To Cost Management And Decision Making

This Video Gave A Good Example Of Price Takers And Price Setters I Found The Examples Given Make It More Relatable Latest Tech Gadgets Relatable Tech Gadgets

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing In 2022 Cost Sheet Accounting And Finance Cost Control

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Student

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Co Cost Sheet Project Management Tools Accounting And Finance

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Distribution Cost Meaning Accounting And More Marketing Strategy Template Accounting And Finance Accounting

Product Costing Cost Accounting Financial Strategies Budgeting Money

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing Cost Sheet Method Accounting And Finance

Cost Accounting Practices For Pricing Decisions Video Lesson Transcript Study Com

Decision Making And Relevant Cost Notes Pdf Accounting Class Accounting Classes Decision Making Accounting

Cost Management Explained In 4 Steps

Business Case Site Design Build Deliver A Better Case Business Case Investing Business Analysis

Comments

Post a Comment